FrenchFood Capital has acquired JV La Française

FrenchFood Capital, a private equity firm focused on food businesses, has acquired JV La Française.

FrenchFood Capital is a private equity firm headquartered in Paris providing equity capital to innovative, fast-growing and value-added SMEs in the food sector with tickets between US$5 million and US$15 million. It supports entrepreneurs in their growth projects in France and abroad, while adopting an environmental, societal and balanced governance approach.

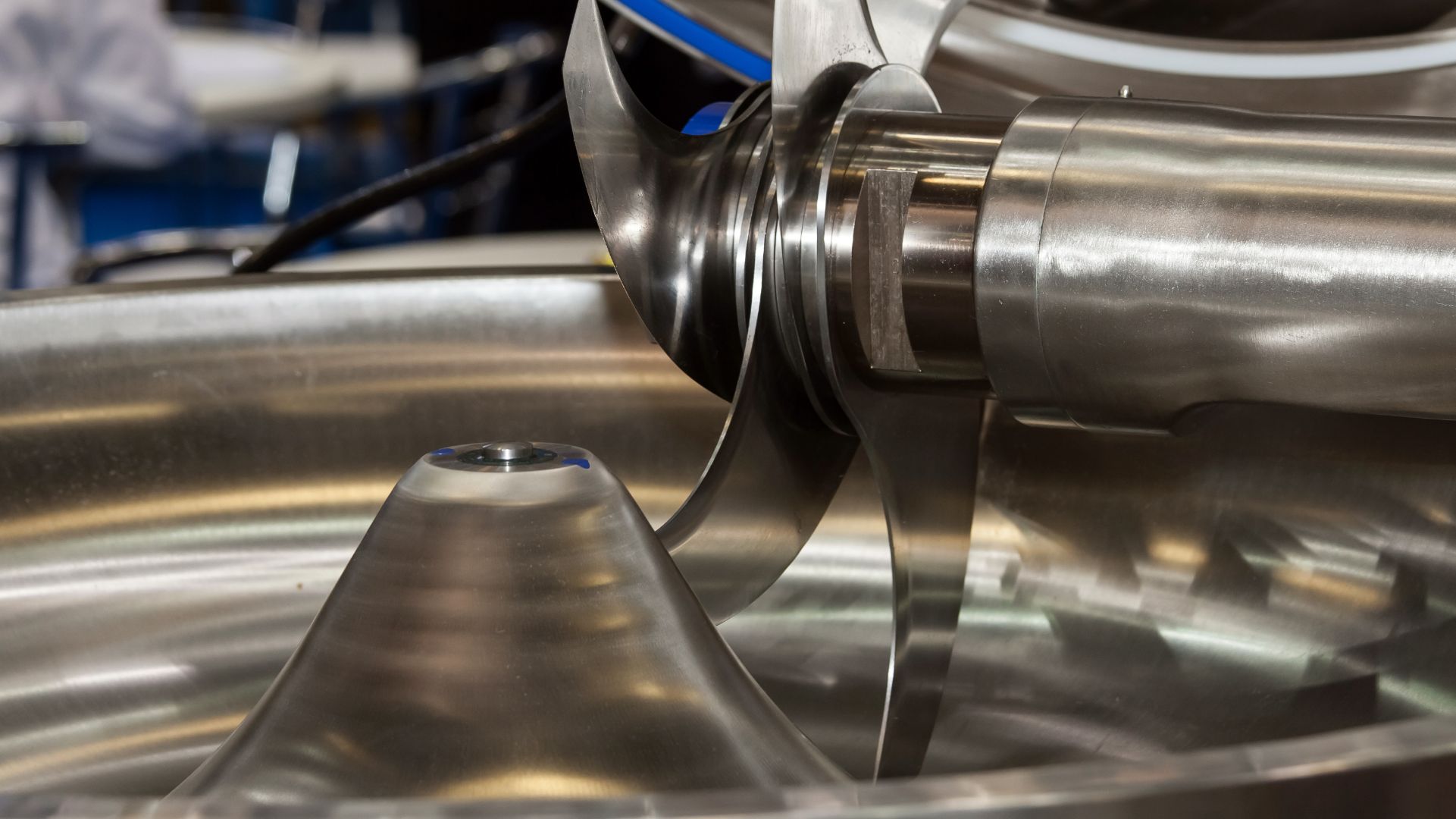

Founded in 1992, JV Groupe specializes in the supply of industrial equipment for the food industry as well as associated value-added services. It assists its customers with all their production equipment needs, from equipment design and selection to the supply of industrial equipment and spare parts management. While addressing the equipment needs of food processors active in the meat/delicatessen and bakery/pastry end-markets, the company targets two categories of clients: industrial and semi-industrial customers—often blue-chip players in France via the JV network—and artisanal retailers, SMEs and on-farm processors through the ADP network, with strong geographical proximity.

Oaklins’ team in France advised FrenchFood Capital in this transaction.

Sprechen Sie mit dem Deal-Team

Hadrien Mollard

Oaklins France

Relevante Transaktionen

He-Man Dual Controls has been acquired by Lagercrantz UK Limited

Lagercrantz UK Limited has acquired 100% of the shares in HM Holding Limited (He-Man Dual Controls), a leader in supplemental control systems for vehicles.

Weitere InformationenAll Glass & Windows has been recapitalized by Cross Rapids Capital

Prospect Partners has sold All Glass & Windows (AGW) to Cross Rapids Capital.

Weitere InformationenHC Partners has successfully secured debt financing for the acquisition of West Friesland Dakbedekkingen

Dutch private equity firm HC Partners has formed a strategic partnership with West Friesland Dakbedekkingen B.V. (WFD). This marks HC Partners’ entry into the roofing sector, with plans to build a national platform of regional roofing specialists.

Weitere Informationen