Tietjen Technologies, Inc. has been acquired by Norlee Investments, LLC

The private shareholders of Tietjen Technologies, Inc. have sold the company to Norlee Investments, LLC.

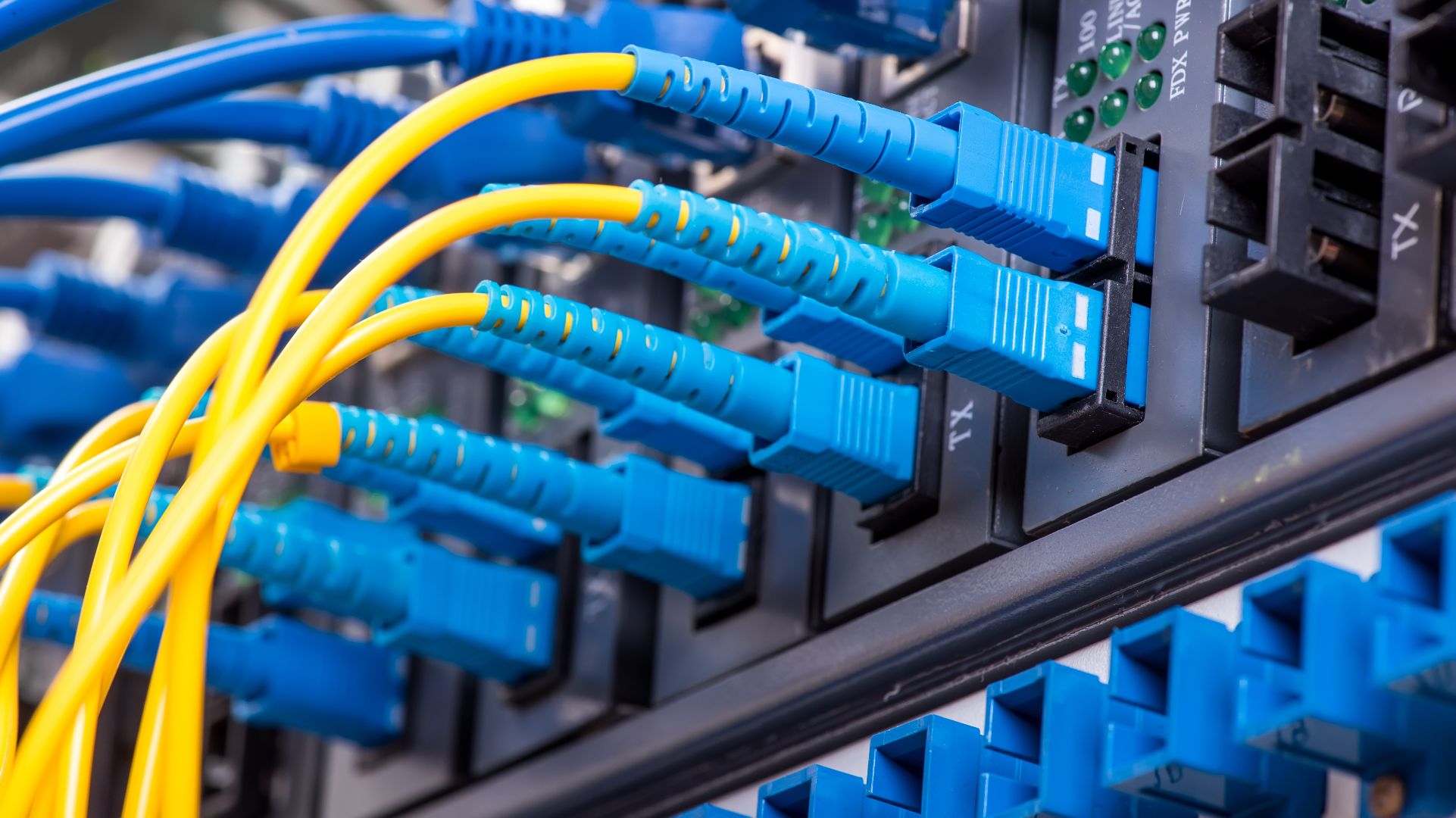

Tietjen was founded in Jacksonville, Florida, in 1994 by Ian Tietjen. The company is considered the premier Florida services provider for the installation of fiber optic cabling, copper network cabling and certification, with many well-established clients throughout Florida and Georgia.

Headquartered in Jacksonville, Norlee owns and operates a portfolio of several highly regarded and successful electrical contracting companies, including Adkins Electric in Jacksonville, Millennium Electric in Orlando, Colwill Engineering in Tampa, in Florida and Pacific Power & Systems in Fairfield, California.

Oaklins Heritage in Jacksonville served as the intermediary and exclusive financial advisor to the seller in this transaction.

Ian Tietjen

Owner, Tietjen Technologies, Inc.

Contacter l'équipe de la transaction

William R. Nicholson

Oaklins Heritage

Bill Sorenson

Oaklins Heritage

Transactions connexes

Darien S.p.A. has launched a voluntary public tender offer for NVP S.p.A.

Darien S.p.A. has initiated a voluntary public tender offer for NVP S.p.A.

En apprendre plusShareDo has been acquired by Clio

In a landmark deal in the legal software sector, ShareDo, a UK-based provider of a cutting-edge SaaS work management platform, trusted by the world’s largest law firms, has been acquired by Clio, a global leader in cloud-based legal technology.

En apprendre plusSCLogic has been acquired by iLobby and rebranded as FacilityOS

The acquisition of SCLogic by iLobby, a portfolio company of Insight Partners, has been successfully completed. This strategic merger combines the strengths of both companies under the newly launched FacilityOS brand, enhancing industry leading delivery, logistics, tracking and other facility management capabilities across global enterprises.

En apprendre plus