Ethos Engineering Limited has been acquired by Exponent

The shareholders of data center designer Ethos Engineering have sold a majority stake to Exponent.

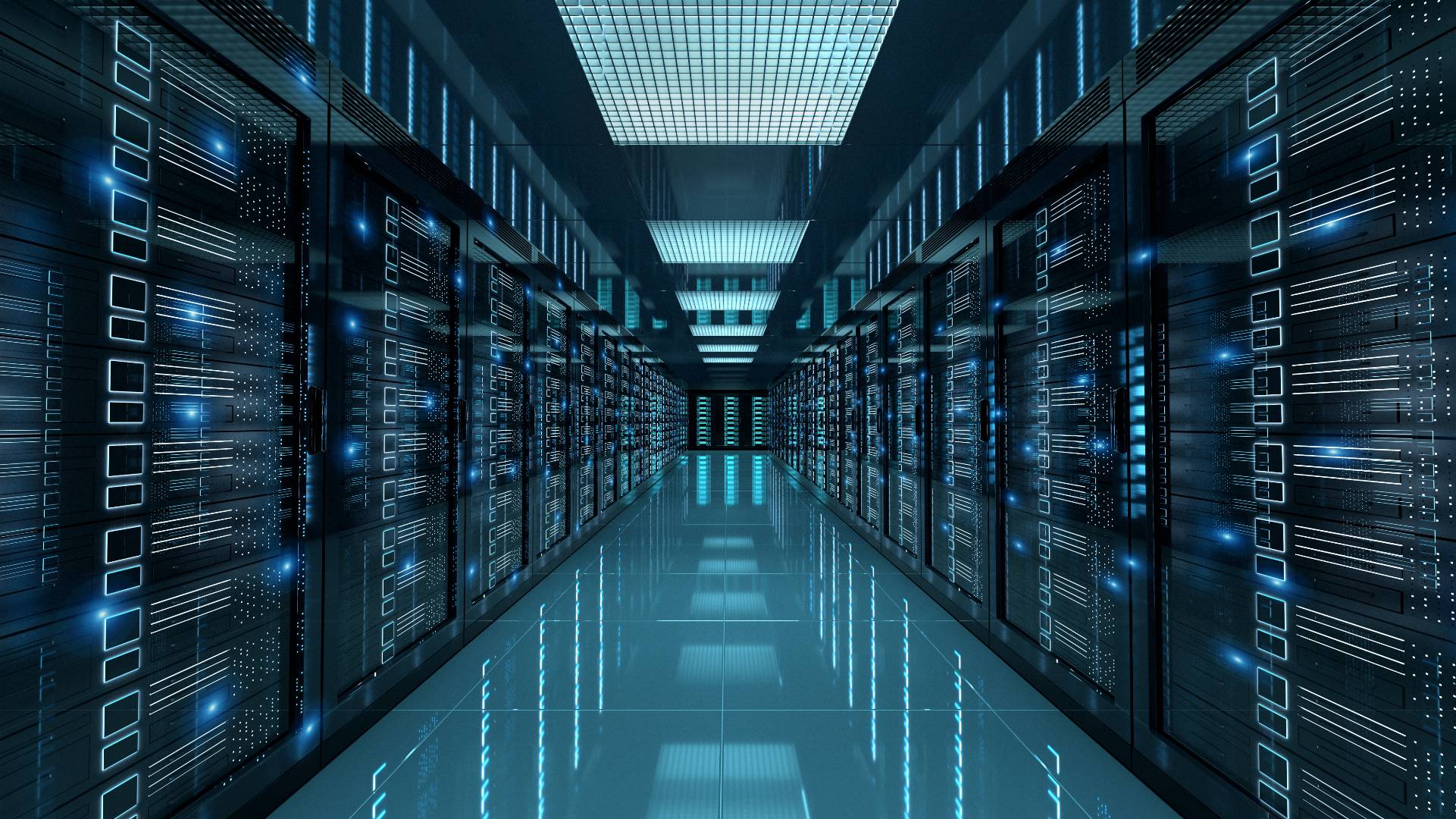

Ethos Engineering is a leading Irish-headquartered, pan-European engineering design consultancy with over 220 employees. It provides mechanical and electrical engineering solutions to a range of blue-chip companies, with a focus on sustainable data center design for some of the world’s leading technology firms. Ethos has worked on more than 90 data centers across 19 countries in EMEA, representing over 2 GW of capacity, as well as being an established market leader in its home market, Ireland. Over the past five years, the company has continued to grow internationally with their blue-chip base, and as of FY23 approximately 80% of its group revenue comes from outside Ireland.

Founded in 2004, Exponent is a prominent European private equity firm that invests in mid-market companies based in the UK, Ireland, Benelux and the Nordics. It has raised more than €3 billion (US$3.8 billion) to date and has offices in London, Dublin and Amsterdam.

Oaklins’ team in Ireland acted as the exclusive sell-side financial advisor to the shareholders of Ethos Engineering in this transaction.

Contáctese con el equipo de la transacción

Transacciones relacionadas

He-Man Dual Controls has been acquired by Lagercrantz UK Limited

Lagercrantz UK Limited has acquired 100% of the shares in HM Holding Limited (He-Man Dual Controls), a leader in supplemental control systems for vehicles.

Aprenda másAll Glass & Windows has been recapitalized by Cross Rapids Capital

Prospect Partners has sold All Glass & Windows (AGW) to Cross Rapids Capital.

Aprenda másHC Partners has successfully secured debt financing for the acquisition of West Friesland Dakbedekkingen

Dutch private equity firm HC Partners has formed a strategic partnership with West Friesland Dakbedekkingen B.V. (WFD). This marks HC Partners’ entry into the roofing sector, with plans to build a national platform of regional roofing specialists.

Aprenda más