CML Métrologie, provider of geometric and 3D measurement services, has been acquired by Trescal

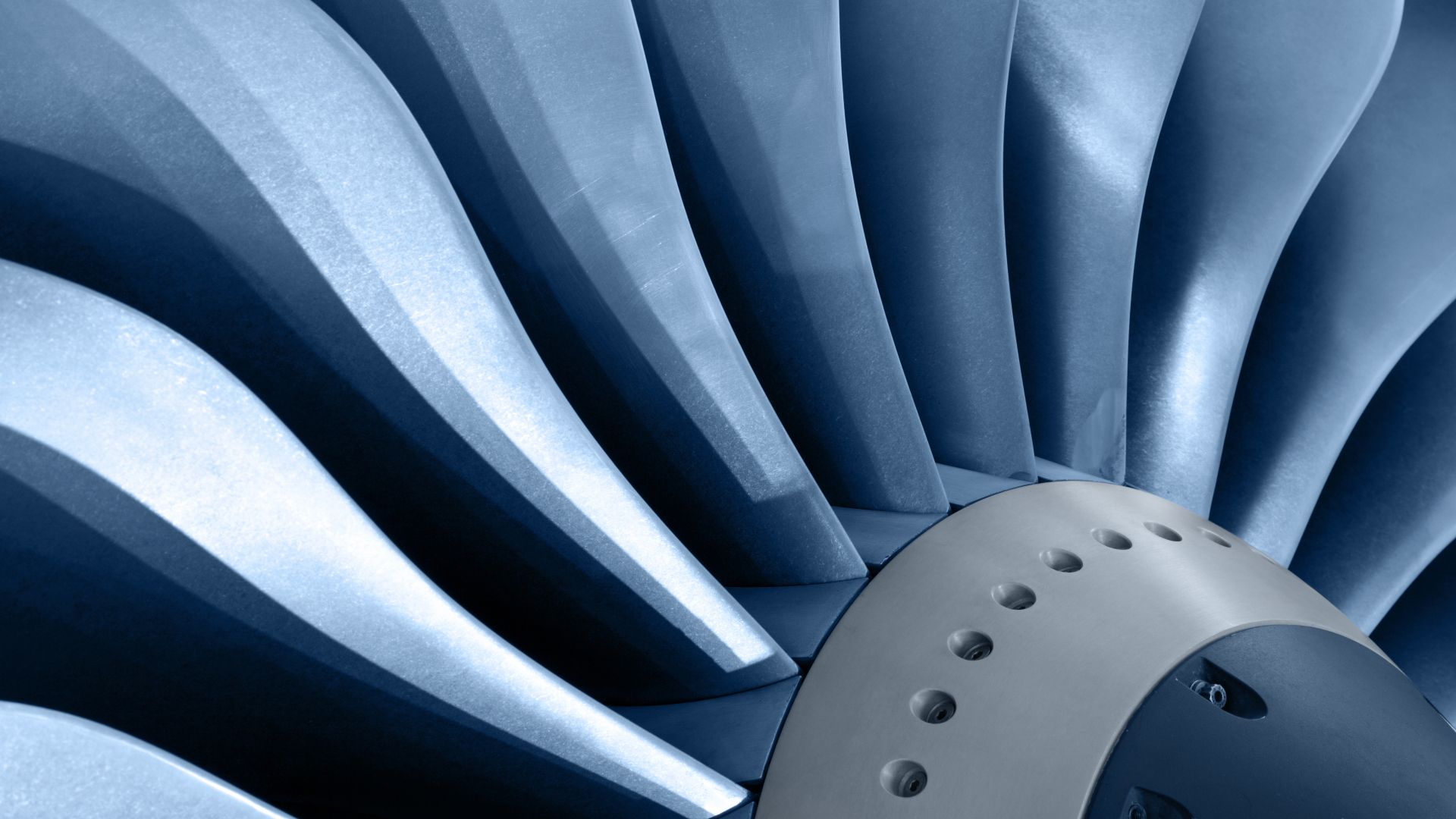

CML Métrologie, the French leader in geometric and 3D measurement services on industrial sites and in laboratories, is joining forces with Trescal, an international expert in calibration services.

CML Métrologie provides metrology services to major industries, such as aerospace & defense, nuclear, research and automotive, as well as their networks of subcontractors. Based in Nantes, Toulouse, Bordeaux and Lyon, CML has 60 employees specialized in technical expertise, quality, service and responsiveness, and offers a comprehensive range of on-site and laboratory services, including laser tracking, mobile scanning, TQC large dimensional scanning, mobile probing, retro design, CMM, a robotic scanning cell, photogrammetry and tomography, with unique capabilities for measuring parts regardless of size.

Trescal is the global leader in metrology services. It offers a unique solution for calibration, repair, qualification, validation and capital goods to a number of key industries worldwide. Its technicians and experts provide accredited and non-accredited services for all physical quantities, measuring instruments and technical fields. Trescal’s 5,500-strong team performs over 3.3 million operations per year, including 27,000 repairs on 150,000 types of instruments and 20,000 brands.

Oaklins’ team in France advised CML Métrologie’s management on the strategic sale of the company. After a selective dual track process involving both major strategic and financial buyers, Trescal was selected as the new industrial partner and owner.

Frank Vezinhet

CEO, CML Métrologie

联系交易团队

相关交易

Micro Nav and Global ATS have been acquired by Indra Sistemas S.A.

Indra Sistemas S.A. strengthens its leadership in global air traffic management (ATM) with the acquisition of 100% of the share capital of Micro Nav and Global ATS from UK-based Quadrant Group. This acquisition enhances Indra’s industry-leading capabilities, solidifying its position as a global player in the air traffic control and management market.

更多信息Canada’s Best Store Fixtures has been acquired by LSI Industries

The acquisition of Canada’s Best Store Fixtures has been successfully completed by LSI Industries to expand its capabilities, geographic reach and market presence, particularly in Canada. CBSF’s expertise and customer relationships complement LSI’s portfolio, creating opportunities for cross-selling and supporting growth in the grocery, quick service restaurant (QSR) and specialty retail sectors.

更多信息CSI DMC has merged with 360 Destination Group

In a landmark move for the destination management industry, CSI DMC, a premier destination event management company, and 360 Destination Group (360DG), a leading national full-service destination management company (DMC), are merging to create one of the largest DMCs in the USA. The merger was facilitated through a strategic investment by H.I.G. Capital.

更多信息