Medis Medical Imaging and GE HealthCare announce collaboration focused on non-invasive coronary assessments

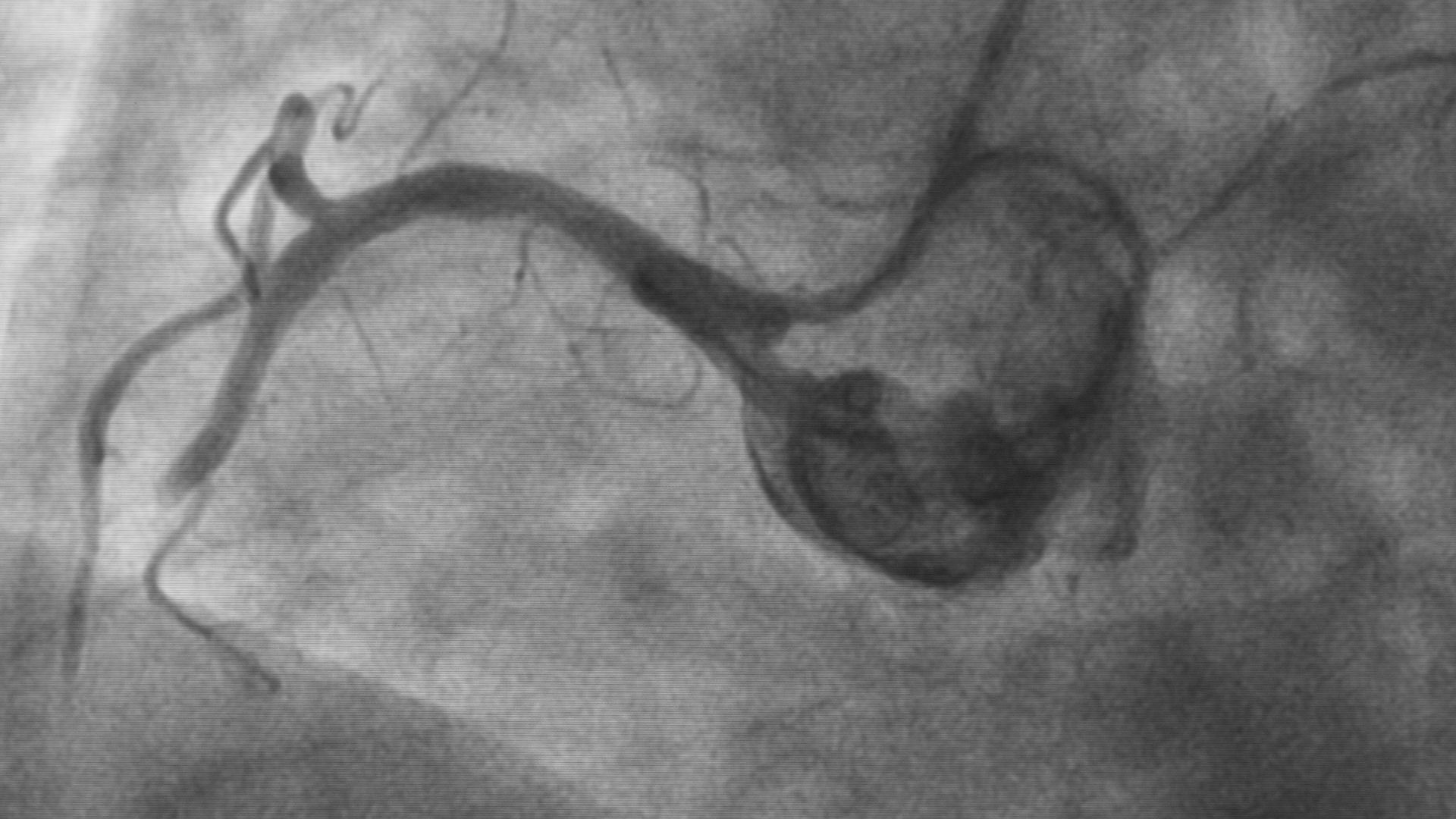

Medis Medical Imaging Systems B.V., a leading cardiac imaging software company, have completed a strategic investment to further develop its revolutionary non-invasive cardiovascular imaging solution. The company has announced its collaboration with GE HealthCare (Nasdaq: GEHC), a global leader in medical technology, pharmaceutical diagnostics and innovation in digital solutions, to contribute to the advancement of precision care in the diagnosis and treatment of coronary artery disease (CAD).

Founded in 1989, Medis Medical Imaging Systems B.V. provides high-quality quantitative analysis solutions for cardiovascular imaging to the medical community. Medis’ software is internationally appreciated due to its ease of use and clinical outcomes for patients. The company continuously focuses on creating, researching and innovating towards clinically relevant software solutions in the field of cardiovascular imaging.

Oaklins’ team in the Netherlands acted as the exclusive strategic advisor to the shareholders and management of Medis Medical Imaging Systems B.V.

Maya Barley

CEO, Medis Medical Imaging Systems B.V.

Talk to the deal team

Related deals

Pharma-Skan & Skan-Medic have been acquired by Brygge Partners

Pharma-Skan, an independent contract manufacturing organization (CMO), and Skan-Medic, a manufacturer of over-the-counter (OTC) products, both operating as a joint entity, have been acquired by Brygge Partners.

Learn moreShareDo has been acquired by Clio

In a landmark deal in the legal software sector, ShareDo, a UK-based provider of a cutting-edge SaaS work management platform, trusted by the world’s largest law firms, has been acquired by Clio, a global leader in cloud-based legal technology.

Learn moreDarien S.p.A. has launched a voluntary public tender offer for NVP S.p.A.

Darien S.p.A. has initiated a voluntary public tender offer for NVP S.p.A.

Learn more