Sondrel secures a major investment

Sondrel has secured funding from Rox Equity Partners Ltd. through a subscription for new shares. The funds will enable the company to grow and expand its presence as one of the world’s leading providers of custom chip design and supply. In particular, it will help them rapidly develop their presence in the US.

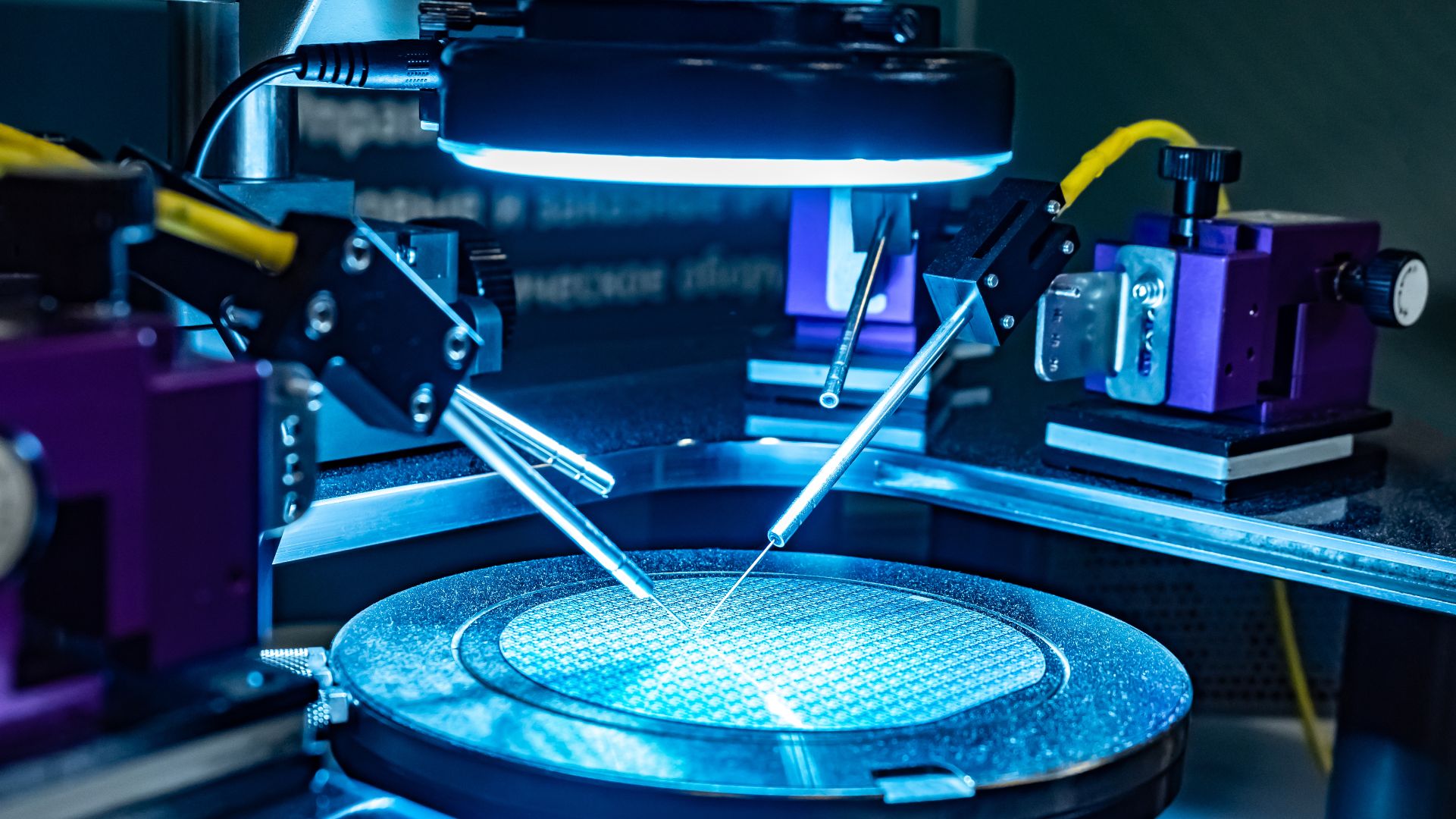

Founded in 2002, Sondrel is a UK-based provider of ultra-complex chips for leading global technology brands. The company offers a complete turnkey ASIC service, from architecture to silicon supply, and can design and supply the highest-spec chips built with the most advanced semiconductor technologies. The firm has design centers in the UK, Morocco and India, and sales representatives in Israel and the US.

Oaklins Cavendish, based in the UK, advised Sondrel on its US$10.9 million capital raising.

Prata med transaktionsteamet

Relaterade affärer

He-Man Dual Controls has been acquired by Lagercrantz UK Limited

Lagercrantz UK Limited has acquired 100% of the shares in HM Holding Limited (He-Man Dual Controls), a leader in supplemental control systems for vehicles.

Lär dig merIRT Technologies has been acquired by ETL Systems

IRT Technologies has been successfully acquired by ETL Systems, unlocking exciting opportunities for innovation and growth. This acquisition strengthens ETL’s satellite communications portfolio and expands its global presence, while allowing IRT Technologies to leverage ETL’s industry expertise and reach.

Lär dig merSunlight Group has acquired a 51% stake in Lehmann Marine GmbH

Through its acquisition of a 51% stake in Lehmann Marine GmbH, Sunlight Group continues to strengthen its position in the growing energy solutions market, while expanding its portfolio of innovative technologies. With over 30 years of expertise in producing lead-acid and lithium-ion batteries, Sunlight Group has established itself as a leader in advanced battery technology.

Lär dig mer