FrenchFood Capital has acquired JV La Française

FrenchFood Capital, a private equity firm focused on food businesses, has acquired JV La Française.

FrenchFood Capital is a private equity firm headquartered in Paris providing equity capital to innovative, fast-growing and value-added SMEs in the food sector with tickets between US$5 million and US$15 million. It supports entrepreneurs in their growth projects in France and abroad, while adopting an environmental, societal and balanced governance approach.

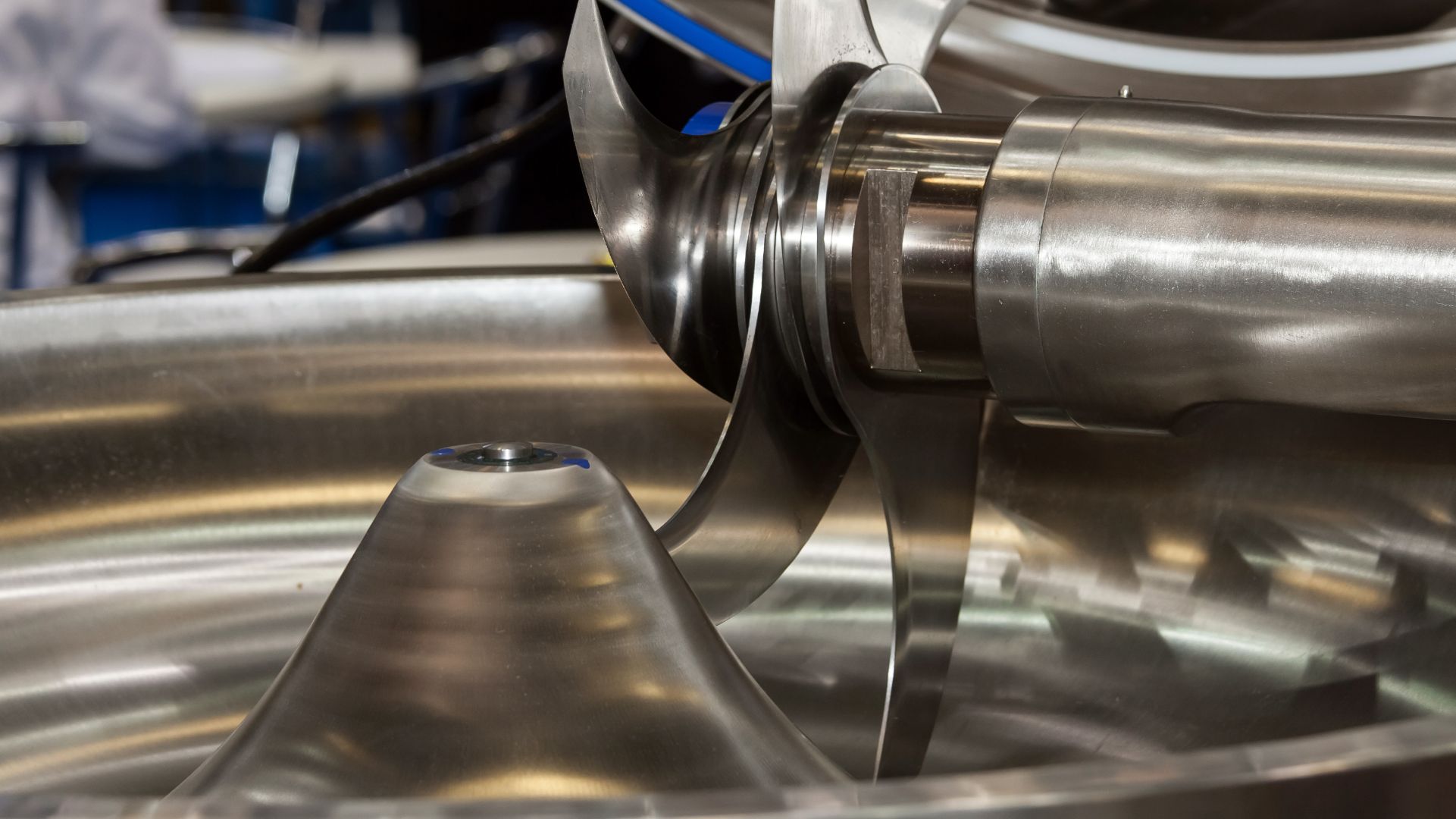

Founded in 1992, JV Groupe specializes in the supply of industrial equipment for the food industry as well as associated value-added services. It assists its customers with all their production equipment needs, from equipment design and selection to the supply of industrial equipment and spare parts management. While addressing the equipment needs of food processors active in the meat/delicatessen and bakery/pastry end-markets, the company targets two categories of clients: industrial and semi-industrial customers—often blue-chip players in France via the JV network—and artisanal retailers, SMEs and on-farm processors through the ADP network, with strong geographical proximity.

Oaklins’ team in France advised FrenchFood Capital in this transaction.

Prata med transaktionsteamet

Relaterade affärer

ABZ Seeds has been acquired by Planasa

ABZ Seeds, a renowned breeder of seed-propagated F1 hybrid strawberry varieties, has been acquired by Planasa, a global leader in breeding next-generation berry varieties, including blueberries, blackberries, raspberries and strawberries.

Lär dig merDen Berk Délice accelerates growth through strategic partnership

Den Berk Délice, a leading Belgian grower of specialty tomatoes, has entered a strategic partnership with Egeria, an independent investment firm, to realize its next growth phase.

Lär dig merXiel Limited has been acquired by MIS Healthcare

MIS Healthcare, a leading distributor in medical imaging, has successfully acquired Xiel Limited. This strategic acquisition merges MIS Healthcare’s extensive radiotherapy portfolio with Xiel’s specialized expertise in nuclear medicine, radiotherapy and diagnostic radiology. The merger strengthens both companies’ positions in the rapidly growing fields of oncology and nuclear medicine, promising to deliver exceptional value to the healthcare community in the UK and Ireland.

Lär dig mer