CML Métrologie, provider of geometric and 3D measurement services, has been acquired by Trescal

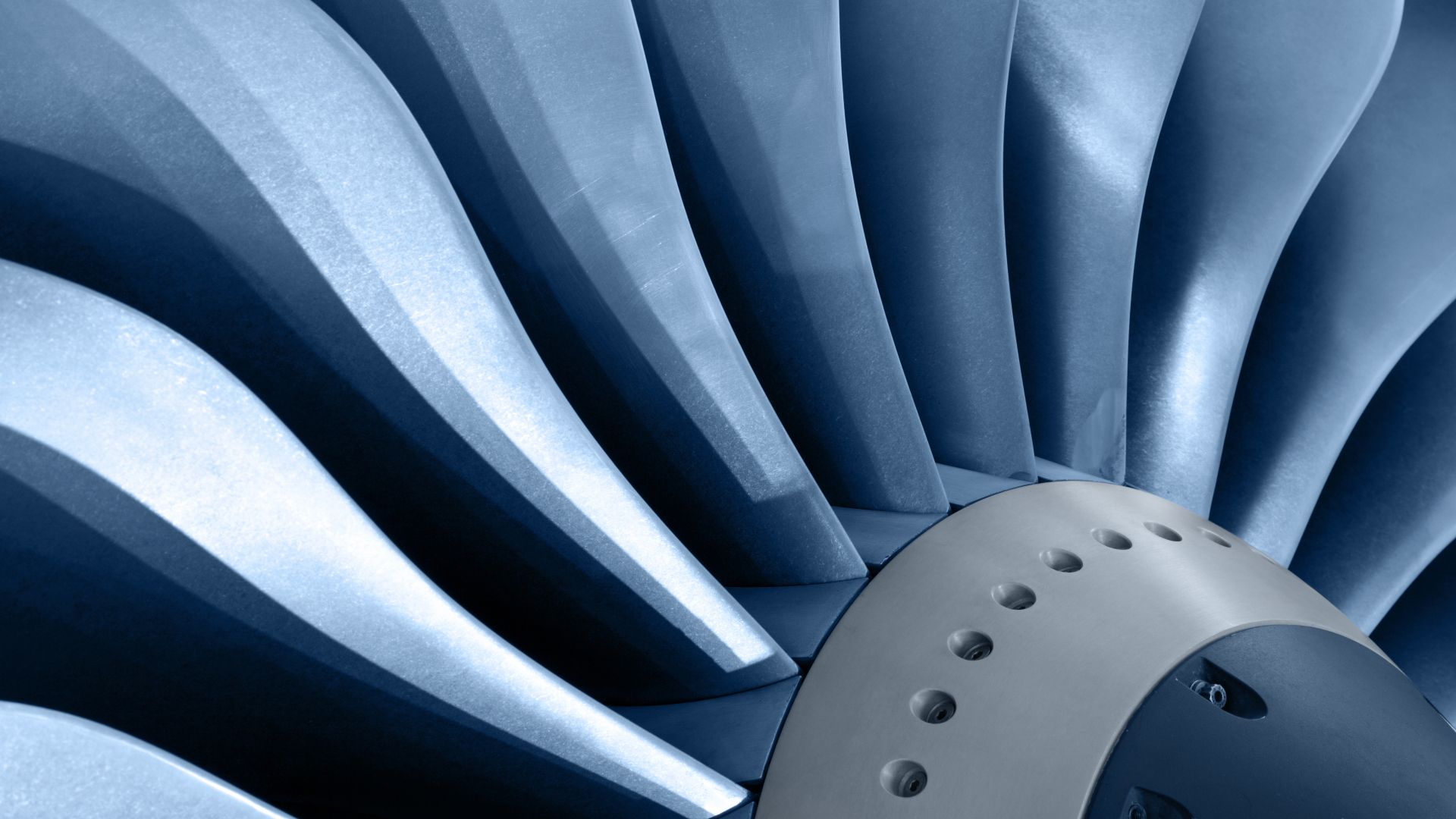

CML Métrologie, the French leader in geometric and 3D measurement services on industrial sites and in laboratories, is joining forces with Trescal, an international expert in calibration services.

CML Métrologie provides metrology services to major industries, such as aerospace & defense, nuclear, research and automotive, as well as their networks of subcontractors. Based in Nantes, Toulouse, Bordeaux and Lyon, CML has 60 employees specialized in technical expertise, quality, service and responsiveness, and offers a comprehensive range of on-site and laboratory services, including laser tracking, mobile scanning, TQC large dimensional scanning, mobile probing, retro design, CMM, a robotic scanning cell, photogrammetry and tomography, with unique capabilities for measuring parts regardless of size.

Trescal is the global leader in metrology services. It offers a unique solution for calibration, repair, qualification, validation and capital goods to a number of key industries worldwide. Its technicians and experts provide accredited and non-accredited services for all physical quantities, measuring instruments and technical fields. Trescal’s 5,500-strong team performs over 3.3 million operations per year, including 27,000 repairs on 150,000 types of instruments and 20,000 brands.

Oaklins’ team in France advised CML Métrologie’s management on the strategic sale of the company. After a selective dual track process involving both major strategic and financial buyers, Trescal was selected as the new industrial partner and owner.

Frank Vezinhet

CEO, CML Métrologie

Talk to the deal team

Related deals

Largest AIM IPO in the business support services sector over the past five years has been completed

MHA plc raised US$131 million (£98 million) through a placing and retail offer, achieving a market capitalization of approximately US$363 million (£271 million) on admission. This was the largest AIM IPO in the business support services sector over the past five years. The IPO provides a platform for continued investment in technology, talent and acquisitions, supporting the group’s ambition to become a top 10 UK professional services firm.

Learn moreManolete Partners plc has completed a successful debt refinancing

Manolete Partners plc has signed a new revolving credit facility (RCF) with its existing provider, HSBC. The new RCF provides Manolete with the same level of facility as the previous arrangement, at US$22.6 million (£17.5 million), but with a reduced margin and lower non-utilization fee. The facility has a term of 3.25 years, with the option to extend for an additional year on the same terms.

Learn moreMicro Nav and Global ATS have been acquired by Indra Sistemas S.A.

Indra Sistemas S.A. strengthens its leadership in global air traffic management (ATM) with the acquisition of 100% of the share capital of Micro Nav and Global ATS from UK-based Quadrant Group. This acquisition enhances Indra’s industry-leading capabilities, solidifying its position as a global player in the air traffic control and management market.

Learn more