PROMA S.p.A. has acquired Allgaier de Puebla, S.A.R.L.

Automotive supplier PROMA S.p.A. has completed the acquisition of Allgaier de Puebla, S.A.R.L., a Mexican company that produces structural components for international car manufacturers. The sale took place as part of the insolvency proceedings of the Allgaier Group.

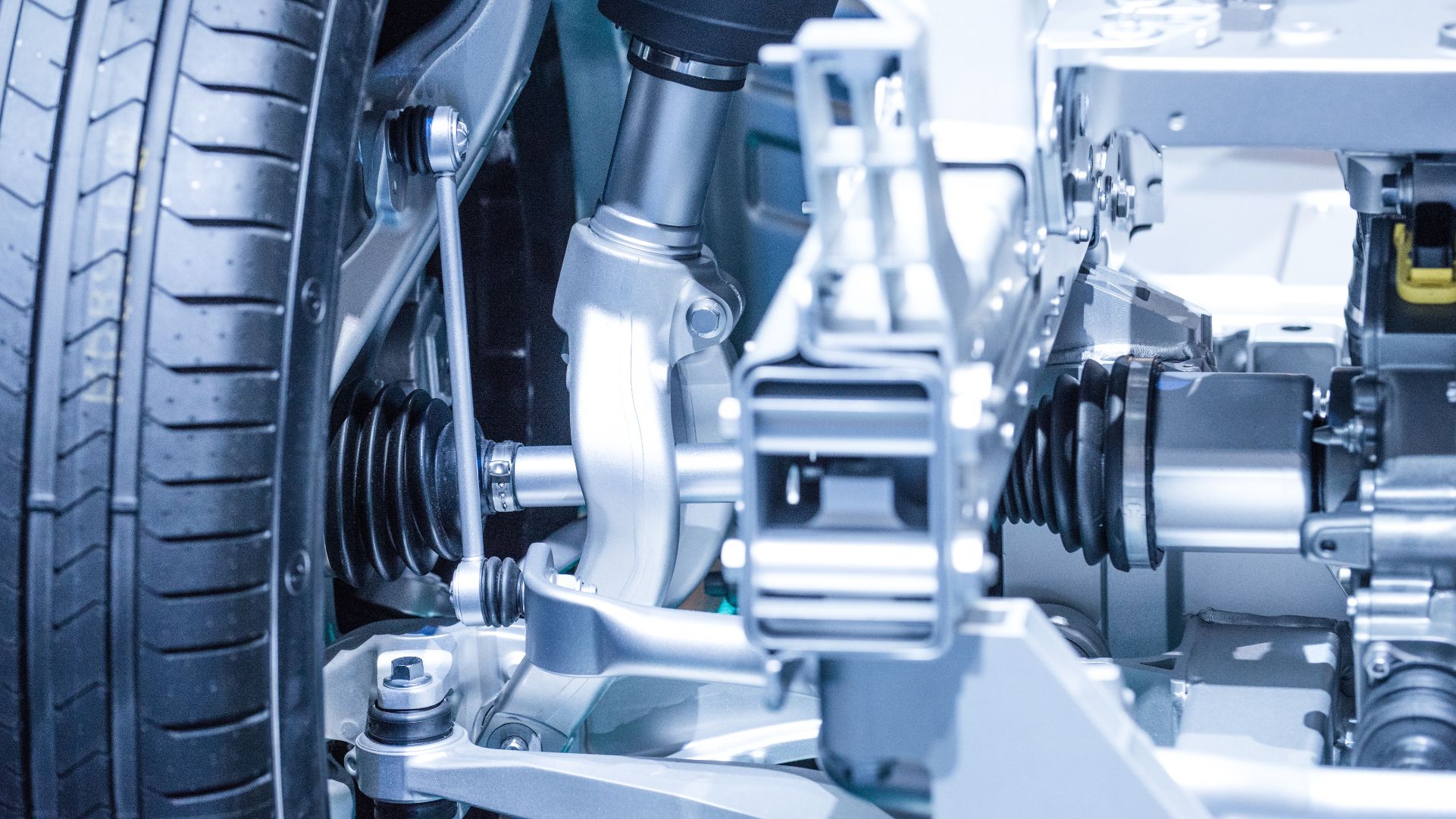

PROMA manufactures components for the automotive sector, specializing in the development and production of seat structures and mechanisms, body assemblies and front-end suspension crossbeams. The company partners with major automotive manufacturers worldwide, collaborating on development projects for hundreds of vehicle platforms. It has 26 manufacturing plants located in eight countries across Europe, South America, North America and Africa. PROMA conducts product and process development at two research and development (R&D) centers and testing labs based in Italy.

Allgaier de Puebla is a supplier to German automakers in the North American market, specializing in the production of structural and chassis components. The company is particularly known for its high level of expertise in cold forming manufacturing and assembly production.

Oaklins’ team in Italy acted as the financial advisor to the family that controls PROMA.

Talk to the deal team

Related deals

He-Man Dual Controls has been acquired by Lagercrantz UK Limited

Lagercrantz UK Limited has acquired 100% of the shares in HM Holding Limited (He-Man Dual Controls), a leader in supplemental control systems for vehicles.

Learn moreSAPA has acquired Megatech Industries

SAPA, the Italian company behind the patented One-Shot® method for delivering industry-leading mobility products, has acquired 100% of Megatech Industries Aktiengesellschaft. This strategic acquisition strengthens SAPA’s market leadership and expands the reach of its One-Shot® technology, combining both companies’ strengths for greater scale in the plastic injection molding sector.

Learn moreAirPro Diagnostics, LLC has been acquired by Rotunda Capital Partners

The acquisition of AirPro Diagnostics, LLC by Rotunda Capital Partners has been successfully completed, marking a significant milestone that will strengthen AirPro’s role as a key service partner in automotive diagnostics. This transaction will accelerate the company’s growth and expand its market reach to meet the growing demand for outsourced, technology-enabled advanced driver assistance systems (ADAS) solutions.

Learn more