OmniMax International has acquired Millennium Metals

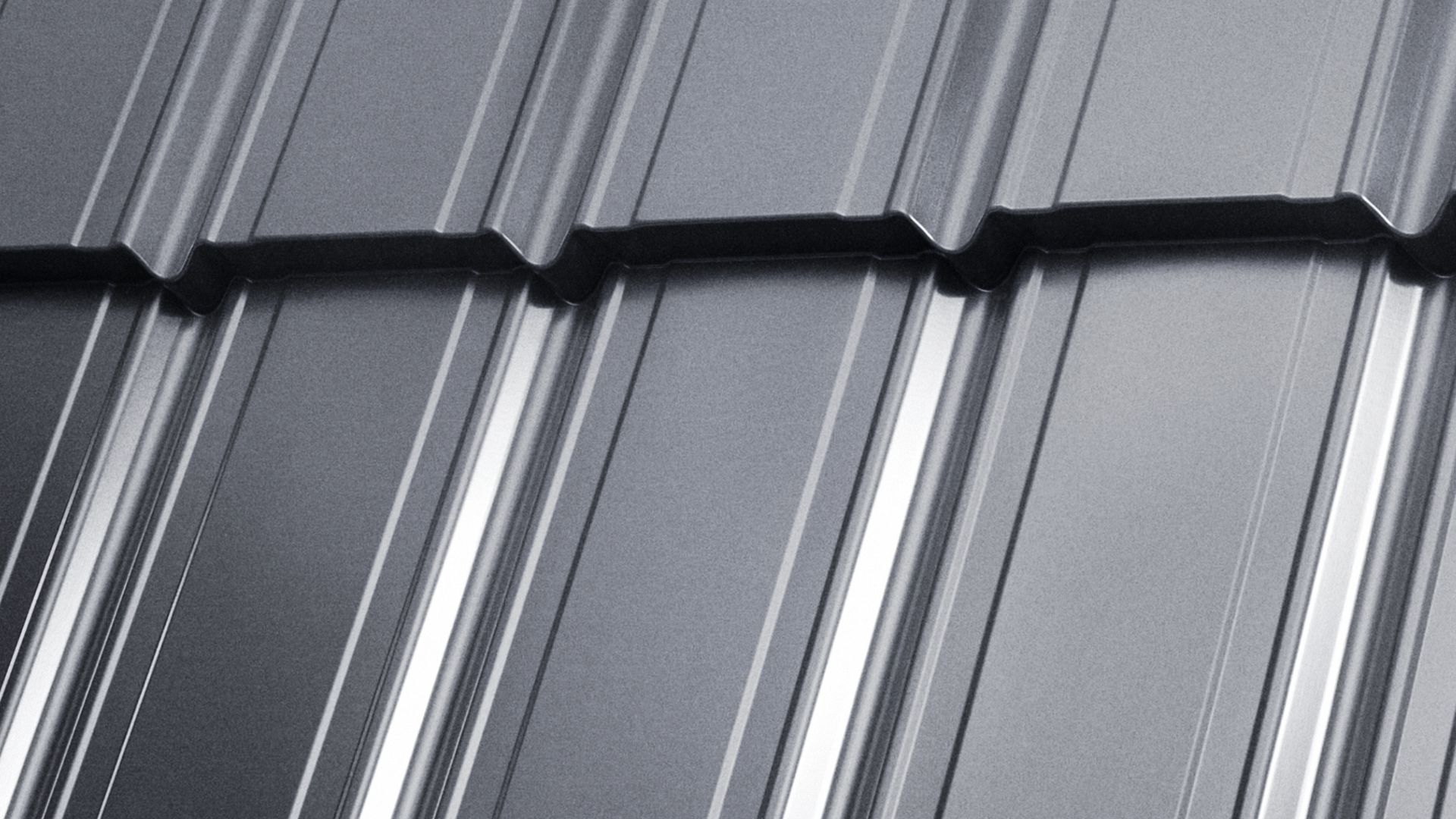

OmniMax International, a leading North American manufacturer of building products, has acquired Millennium Metals, a prominent roofing accessories manufacturer based in Jacksonville, Florida. This strategic acquisition expands OmniMax’s portfolio, bolsters its market presence and strengthens its leadership in the residential roofing accessories market across Florida and the Southeastern United States.

With a history of innovation and excellence, OmniMax operates 12 manufacturing facilities across the USA and Canada, and is known for its industry-leading brands such as Amerimax, Berger, Verde and Flamco. Backed by Strategic Value Partners, LLC (SVP), OmniMax has consistently pursued growth through strategic acquisitions and product expansion. SVP has teams of investment professionals, business development executives, operating partners and an advisory council of former senior bank executives and chairpersons. It’s headquartered in Greenwich, CT and has operations in London, Tokyo and New York.

Millennium Metals has built a 25-year legacy of delivering quality roofing accessories and exceptional service to its regional customer base. Joining OmniMax provides Millennium with enhanced manufacturing capabilities and a broader product offering to deliver unparalleled quality, service and value to their customers, while also creating new opportunities for employees and stakeholders.

As OmniMax’s buy-side advisor, Oaklins Heritage in Jacksonville identified Millennium Metals as a strategic target, guided the valuation and due diligence processes, and facilitated negotiations to ensure a seamless transaction. By leveraging market expertise and managing communications, Oaklins’ team in Jacksonville helped OmniMax secure a growth-enhancing acquisition that strengthens its portfolio and positions it for continued success in the roofing accessories market.

Mike Kuharski

Chief strategy and development officer, OmniMax International, LLC

Talk to the deal team

Related deals

All Glass & Windows has been recapitalized by Cross Rapids Capital

Prospect Partners has sold All Glass & Windows (AGW) to Cross Rapids Capital.

Learn moreHC Partners has successfully secured debt financing for the acquisition of West Friesland Dakbedekkingen

Dutch private equity firm HC Partners has formed a strategic partnership with West Friesland Dakbedekkingen B.V. (WFD). This marks HC Partners’ entry into the roofing sector, with plans to build a national platform of regional roofing specialists.

Learn moreARTEMIS International AG has completed a valuation

ARTEMIS International AG has completed a valuation to determine the Austrian foundation entry tax, as both founders are Austrian taxpayers.

Learn more