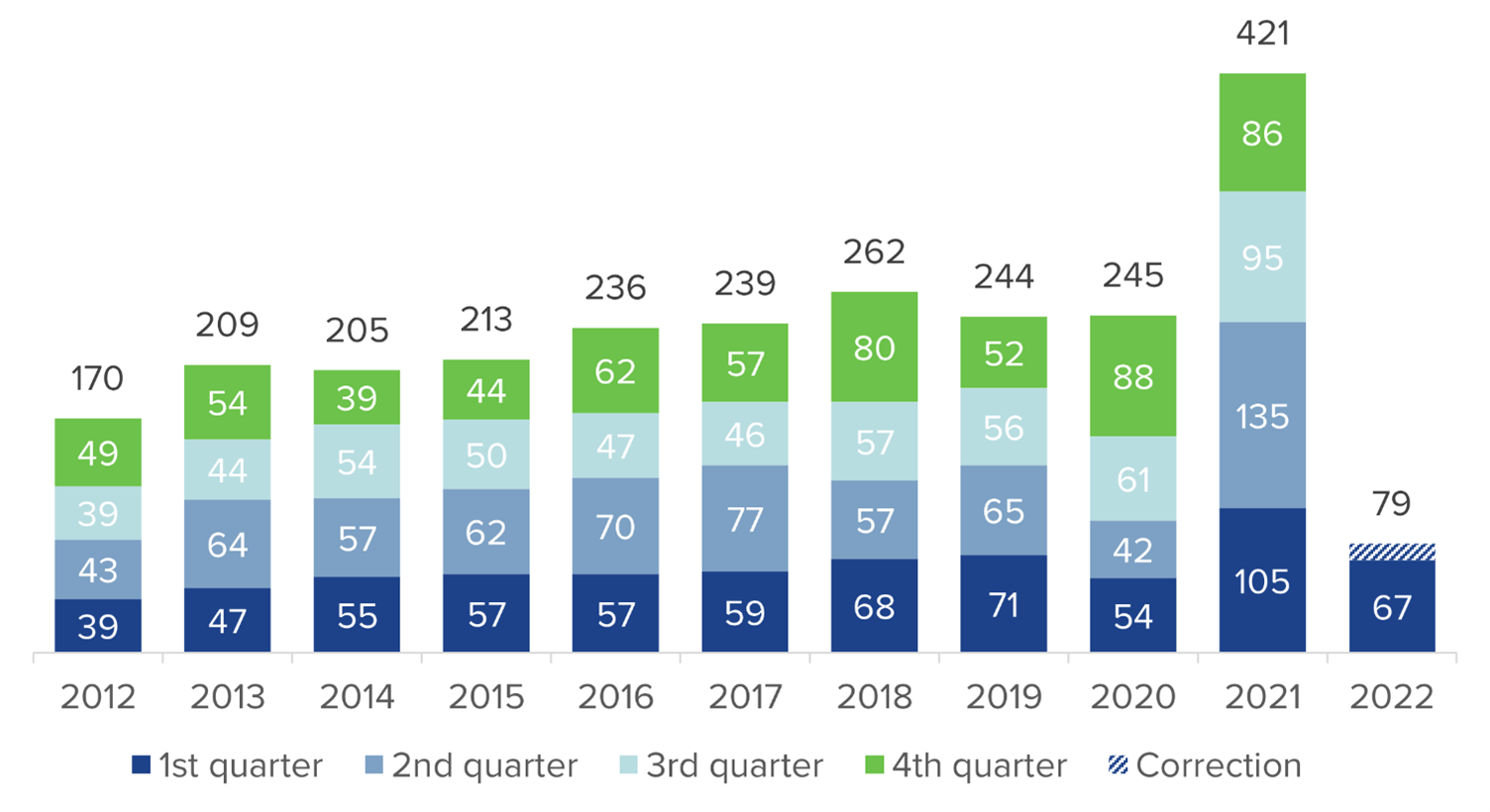

M&A activity in Denmark and Europe is off to a good start in the first quarter of 2022, with a slight decrease compared to the record-high levels of 2021

Summary

The M&A activity in the first quarter of 2022 has had a good start, only slightly below the all-time-high levels seen in 2021. This indicates a strong market, which is so far showing resilience to uncertainty following COVID-19 and the changing geopolitical situation.

In Denmark, the first quarter of 2022 shows a high activity level for Danish company sales for a first quarter. When looking at the European M&A-market, the level of activity in Q1 2022 also reflects a high activity level and even shows an increase from Q4 2021. The high activity in Denmark and most of Europe reflects a generally strong market. 2021 had an element of catch-up from transactions postponed due to COVID-19, and the current activity level can be seen as a more normalised yet strong level. While the M&A-market is looking beyond COVID-19, it is still too early to evaluate the knock-on effects from the war in Ukraine and the current supply-chain challenges that many companies are experiencing, but market confidence has so far remained strong.

While we should not expect 2022 to reach the record levels of 2021, based on the activity we are seeing in Q1, both in Oaklins and the broader market, we expect 2022 to be another strong year. Uncertainty remains present, now more on the geopolitical and supply-chain level than COVID-19, with the M&A market so far displaying a strong resilienceDANIEL SAND – MANAGING PARTNER, OAKLINS DENMARK

Download the report

Read more – download the report as PDF.

Managing Partner

View profile

Analyst

View profile